2014 was a “solid” year for the global wealth management sector in terms of merger and acquisition activity, according to data from Scorpio Partnership which, among other regional trends, indicates that institutions in North America are focusing more on domestic operations.

The global average price of wealth management M&A deals, as a percentage of assets under management, rose to 2.1 per cent from 2013's “low” price of 1.3 per cent. Meanwhile, the total value of M&A check-writing for transactions stood at $12.9 billion in 2014, up from $8.1 billion in the previous year.

The global wealth management industry, albeit with regional variations, has seen a flurry of deals as some firms have sought to build scale to cope with regulatory costs and client demands while others have disposed of businesses seen as unprofitable or non-core. Some examples include the purchase in 2012 by Julius Baer of Bank of America Merrill Lynch's non-US wealth business, and the sale by Morgan Stanley of part of its non-domestic private banking business.

While the average deal price rose in 2014, the volume of private client assets changing hands fell to $461.3 billion from $779.8 billion in 2013 . This could suggest that “a pursuit for quality over quantity has returned to the wealth management market,” said Sebastian Dovey, managing director at Scorpio, the consultancy.

“Pricing levels rebounded to the 2 per cent mark after a mood of quick selling in 2013 depressed deal values – particularly in the UK,” Dovey added. “The pace of deal making may be dropping off slightly compared to last year but it is still moving at a strong clip.”

The data comes from Scorpio's 2015 Wealth Management Deal Tracker report, which is part of a global project that has covered 368 deals over a seven-year period representing $2.2 trillion in aggregate. Last year, a total of $0.5 trillion of wealth management assets changed hands.

“While each year of deals represents a different set of context points, at a macro level the results for 2014 suggest a recovery in valuations is taking place in the industry with less emphasis on quick sale mentality in certain markets,” Scorpio said.

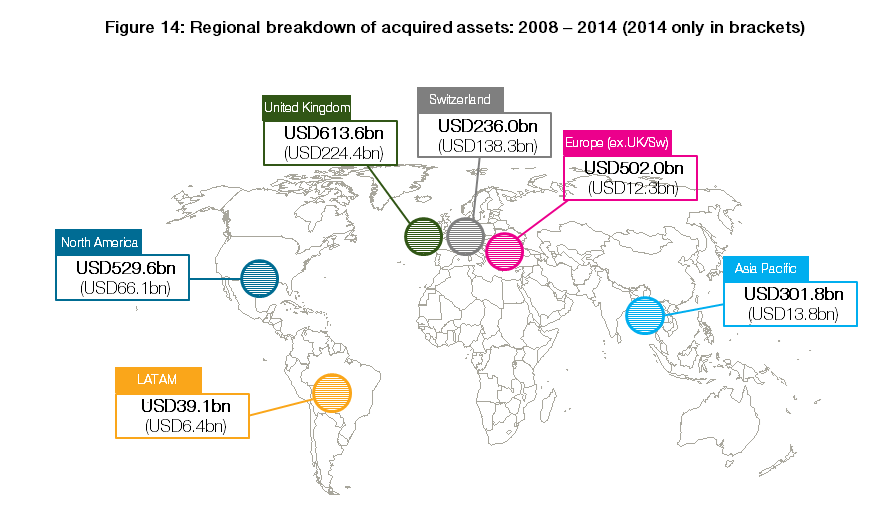

Since 2008, North America has accounted for 23 per cent of all AuM changing hands while Europe has represented 60 per cent and Asia-Pacific 14 per cent. Scorpio said the UK market leads the way in M&A deals , as factors including tightening costs and new regulation - the Retail Distribution Review, for example - have prompted some firms to build economies of scale while others have offloaded.

Here is a regional breakdown of global wealth management M&A in AuM terms

Regional trends

Dovey told this publication that while in the European – and particularly the Swiss – markets there is a drive toward banking-led M&A transactions, in North America acquisitions are motivated primarily by advisory and investment-led opportunities.

“The battleground in the States – with specific reference to M&A – is around buying businesses that secure greater mind share of the client and their wealth,” Dovey said. “The US firms invested in platforms and processing deals several years back.”

He added that the lure of the international cross-border markets has “frustrated all but a very few,” in the region. “In global private banking terms there are really only a handful of North American operators seriously committing to this.”

Also of note in Scorpio's latest M&A report is that the volume of assets changing hands in Switzerland alone represented $138.3 billion in 2014 – the largest amount ever recorded in the country. Over the seven years of tracking wealth management M&A, that figure represents 59 per cent of all assets shifted in the Swiss market.

“The prolonged adjustment in the Swiss market related to changes in global regulation is a major factor coupled with strong headwinds in operating costs for Swiss-based operators,” Scorpio said.